In yesterday’s seminar, we discussed Matthew Rendall’s fascinating article about protecting our grandchildren against climate catastrophe at their own expense. The article builds on the idea that under certain assumptions our grandchildren might be much better off than we are.

In yesterday’s seminar, we discussed Matthew Rendall’s fascinating article about protecting our grandchildren against climate catastrophe at their own expense. The article builds on the idea that under certain assumptions our grandchildren might be much better off than we are.

This assumption about rising levels of welfare caused a lot of protest. The point that still bothers me in this whole discussion is this: How on earth could we actually give reasons for claims to the effect that future generations will be better off than us or worse off than us?

I suggested some ways of giving reasons for such claims here. Here’s a further method one could use for avoiding arbitrariness about predictions about the future:

- Estimate your own gut feeling about the future being richer or poorer than us.

- Think hard and carefully about the direction in which our gut feeling is probably distorted by biases.

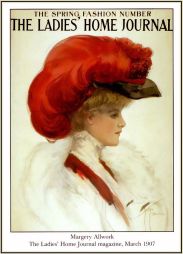

In that context, it might also be instructive to see whether the past over- or underestimated future welfare rises. A fun and interesting example is from the Ladies Home Journal of December 1900. A journalist asked the “wisest and most careful men in our greatest institutions of science and learning” what they expect the world to look like in 2001. Read here for yourself.

They predicted peas as large as beets and strawberries as large as apples. Sometimes the forecasts are quite good, though. Twitter even seems to have made this prophecy come true “Spelling by sound will have been adopted, first by the newspapers. English will be a language of condensed words expressing condensed ideas (…)”.

Glad my paper provoked some discussion! It’s worth noting that one of the main justifications economists like William Nordhaus for ‘discounting the future’ at a fairly high rate is that future people will be richer. So *if we assume they’re right*, then there wouldn’t be an objection of equity to ‘borrowing from the future’ to reduce GHG emissions. If, on the other hand, they’re *wrong*, then the justification for discounting the future based on considerations of inequality aversion–the ‘eta’ in the Ramsey equation–evaporates. In that case, the expected value of mitigation is pretty high, as the Stern Review–which employed a low discount rate–argued. So *either way*, ‘borrowing from the future’ for purposes of mitigation is the way to go.

Incidentally, John Broome also argues in favour of doing this in his new book (*Climate Matters*, pp. 43-48), though in contrast to me he sees it as morally a second-best option (the *best* choice, he thinks, would be that we pay for mitigation ourselves; he’s just concerned we won’t do it). He’s drawing on a paper by Duncan Foley, ‘The economic fundamentals of global warming’, which is available online and very much worth looking up.